Identity theft refers to the illicit use of someone’s personal data for financial gain, obtained through a plethora of complex techniques. Even before the COVID-19 crisis hit, this was already a serious issue, affecting millions of people in the US. But with the pandemic forcing consumers to do much of their purchasing online and in the domain of many such scammers, identity theft statistics have become truly frightening. That’s why we’ve prepared some essential stats and facts to help you keep your identity safe this year and beyond.

Identity Theft Statistics (Editor’s Choice)

- One in 10 Americans has been directly affected by identity theft.

- On average, 9 million Americans have their identities stolen every year.

- Active social media users are 30% more at risk of having their identities stolen.

- Millennials make up 33% of identity theft victims.

- The identity fraud loss totaled $56 billion in 2020.

- Children are 51 times more likely to become identity theft victims.

- Over 6 billion data breaches have occurred in the US since 2013.

- Only 1 in 700 identity thieves are caught and prosecuted.

Identity Theft Statistics

1. Over 12,000 data breaches have been recorded since 2005.

During the same period, over 11 billion records were stolen, adding fuel to the identity theft problem. This is despite the stricter measures implemented to prevent data theft. The identity theft rate suggests that fraudsters are becoming more effective at circumventing measures.

(Comparitech)

2. One in 10 people in the US has been directly affected by identity fraud or knows someone who has.

Identity theft percentage data shows that 10% of US citizens have either been directly affected by identity fraud or know someone who has. 21% of all victims meanwhile have reported this happening on more than one occasion. Identity theft stats basically suggest you know of at least one person who has been affected, even if you haven’t been.

(Center for Victim Research)

3. People who actively use social media are at a 30% higher risk of identity theft.

Social media has become a necessity of modern life and a valuable source of information for employers who increasingly conduct social media background checks on potential candidates. But it also puts people in danger of becoming cybercrime identity theft cases. Anyone with a social media account is immediately at higher risk of identity theft, which in 2020 was pretty much everyone. Facebook, Snapchat, and Instagram users are at even greater risk at 46%, with online identity theft statistics suggesting these platforms are more susceptible to this type of fraud.

(Javelin Strategy)

4. Only around 25% of people online use a VPN to shield themselves from identity theft.

Even with the increase in recent cybercrime identity theft cases, only 25% of people have employed an established VPN or virtual private network. Internet safety statistics suggest that VPNs are an effective tool in the fight against identity theft and should be standard practice for internet users in 2021.

(Primo Europe)

5. Identity theft was one of the most common issues consumers reported in 2020.

And according to the FTC, there is no sign of that changing anytime soon as scammers become more wily in their methods and working around various protections. FTC statistics on identity theft claim this accounts for 29% of all reported frauds consumers experience in the marketplace.

(FTC)

6. Nine million Americans will be affected by identity theft each year on average.

Similar reporting suggests that as many as nine million people’s identities are stolen every year stateside. This is one of the most costly, invasive, and damaging scams to have gained traction in recent times. Professional identity thieves have become nearly impossible to catch, and synthetic identity fraud statistics suggest it puts both families and businesses at risk. With the majority of employers and lenders collaborating with background check companies to screen applicants, victims often face difficulties in landing a job and accessing credit.

(Crime Museum)

Who Are the Victims of Identity Theft?

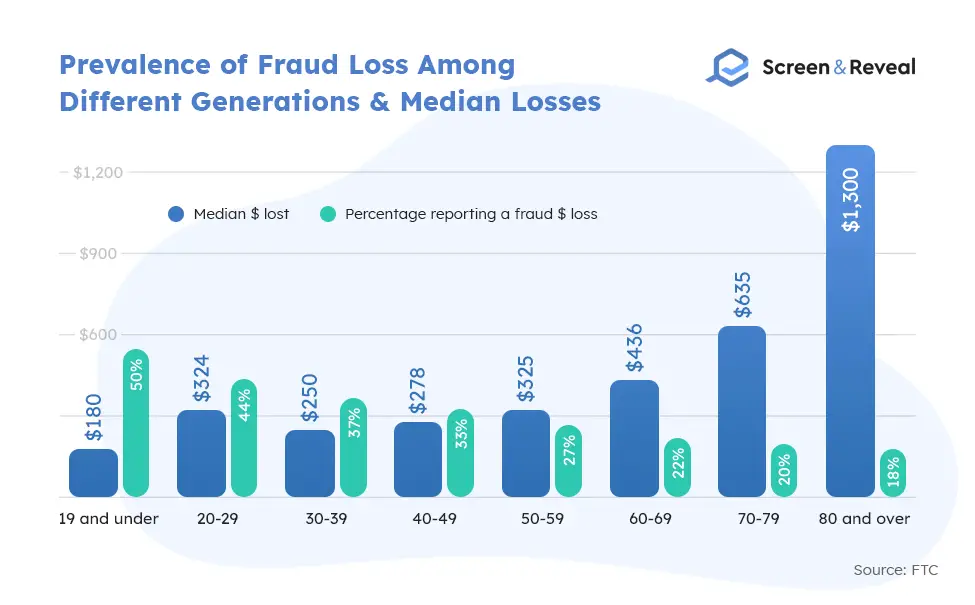

7. People aged 30 – 39 make up the most of identity fraud cases.

According to identity theft facts and statistics, those between 30 and 39 are most in danger of having their identities stolen. This age group accounted for as many as 306,090 identity theft reports in 2020. In contrast, only 9,915 of those over the age of 80 have been affected. These theft statistics are again expected to rise in the future due to the agency launching a platform for people to report fraud online.

(FTC)

8. Children are 51 times more likely to be the target of identity theft.

It’s a very unsettling statistic, and the reason that children are the focus of these thefts is due to the fact that they have clean financial records, and it may be many years before the scam is exposed. Child identity theft statistics further suggest that thieves are targeting minors for their unused social security numbers.

(Carnegie Mellon University/CyLab)

9. 14% of minors who are victims of identity theft are between 13 and 17.

Though children under the age of eight are the most susceptible to these identity frauds (66%), data suggests that teens are targeted too. Even children who are around five years away from attempting to open lines of credit are valuable to scammers, even if there is a drop off in the number of cases as they near that point. Teenage identity theft statistics meanwhile show that these cases could cost families hundreds of thousands of dollars in an attempt to resolve them.

(CreditCards.com)

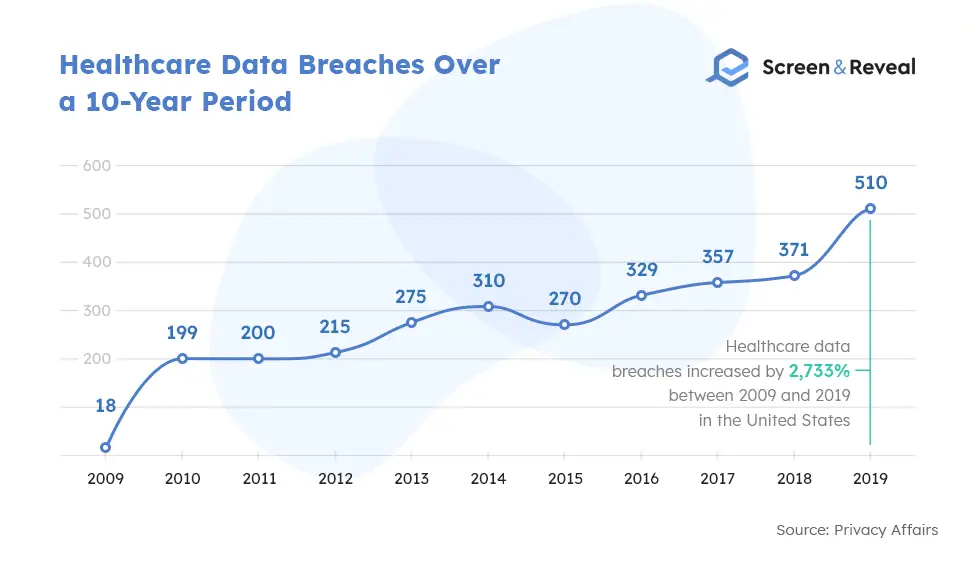

10. The number of healthcare breaches rose by 2,733% over a ten-year period.

Medical identity fraud and theft is another case of identity theft growing all across the US, albeit at different rates in different locations, creating areas of higher risk. These cases can take a lot of time, money, and legal work to resolve.

There are some warning signs to look out for, such as being incorrectly billed, getting calls from third-party debt collectors, or being notified of benefit limits you haven’t used. Medical identity theft statistics suggest more needs to be done to stop these from occurring in the first place and for healthcare providers to get serious about tackling them. Healthcare organizations also must conduct detailed healthcare background checks and continuous monitoring on everyone involved in patient care and handling medical records.

(PrivacyAffairs.com)

11. Identity theft losses reached a staggering $56 billion in 2020.

$43 billion of that cost occurred due to identity theft scams and $13 billion due to traditional identity theft frauds. The lack of transactional activity in 2020 due to the pandemic hasn’t stopped identity thieves from stripping people of their identities, and finances. They’ve focused on reaching out to potential victims directly, using different tactics from chatbots and robocalls to email and text. Social media requests and chatbots were the most prevalent identity theft tactics among the youngest generations, while robocalls mainly were used for targeting the older population.

(Javelin Strategy)

12. The U.S. has the highest total of data records lost or stolen of any other country.

Over six billion data records have been lost or stolen since 2013, making it by far the most affected country. Several factors at play make the United States a prime location for data theft: the number of large corporations, degree of technological adoption, and population size. Measuring identity theft statistics by country isn’t an exact science. Still, other heavily affected nations with a high rate of identity theft include India, China, South Korea, the UK, Turkey, Japan, South Africa, and France.

(Varonis)

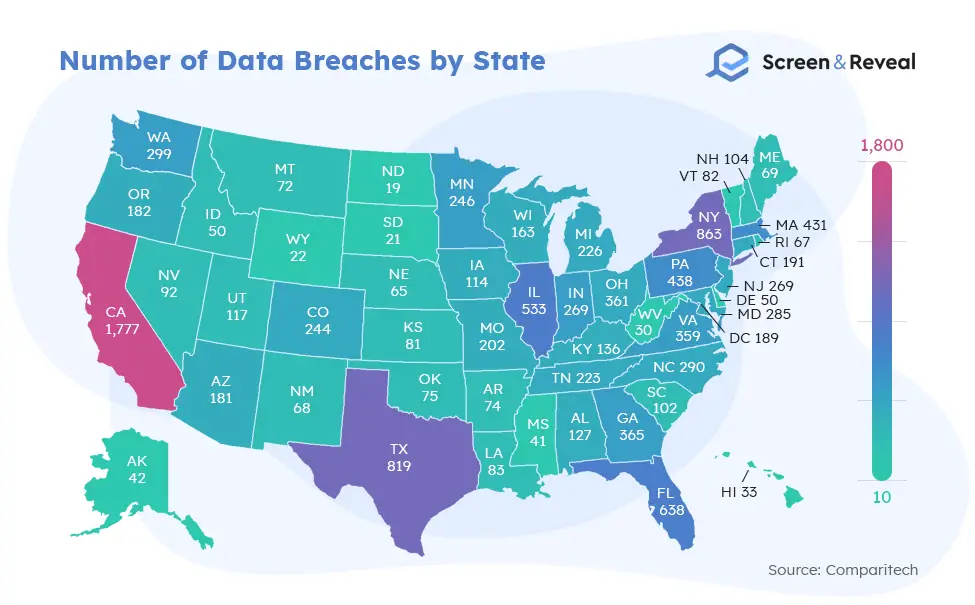

13. California has been the most affected state since 2005, with 1,777 breaches.

The number of identity thefts per year doesn’t always correlate directly with the number of breaches that occur, but in the latter case, California is by far the worst hit. The next most affected is New York, then Texas, Florida, and Illinois. According to fraud stats, North Dakota, South Dakota, and West Virginia are the least affected of all the states. Examining these identity theft statistics by state means, local governments can be aware of the threat faced by data beaches and stamp them out accordingly.

(Comparitech)

Identity Theft FAQ

Where is identity theft most common in the world?

Stats about identity theft show the US has the highest fraud rate globally and has been the subject of over six billion data breaches since 2013. Some states are more affected than others. In a global sense, it is almost twice as much as India, which comes in second.

What percent of Americans are victims of identity theft?

As many as one in four or about 23% of Americans were affected by identity theft. This number is expected to increase over the coming year as well. In 45% of the cases, the victims have lost over $1,000, with 62% of them getting their money back, according to identity fraud statistics.

What are the odds of having your identity stolen?

Fraud statistics show certain factors impact the likelihood of having your identity stolen. These include: where you live, how often your personal data has been breached, how many sites you access with the same credentials, and who is close to you.

How do thieves steal your identity?

Fraudsters use various complex tools to steal data. Some of these methods include opening a credit-monitoring account in your name, using Google Maps, Zillow, and Redfin to target your location, and hacking your devices with malware. These modern ways of stealing data mean dumpster diving identity theft statistics are down.

How long does it take to investigate identity theft?

Identity theft is serious business and will never be something you can resolve overnight or even in a week. Online fraud statistics suggest the average amount of time it takes to conclude a successful investigation is anywhere from 100-200 hours to six months.

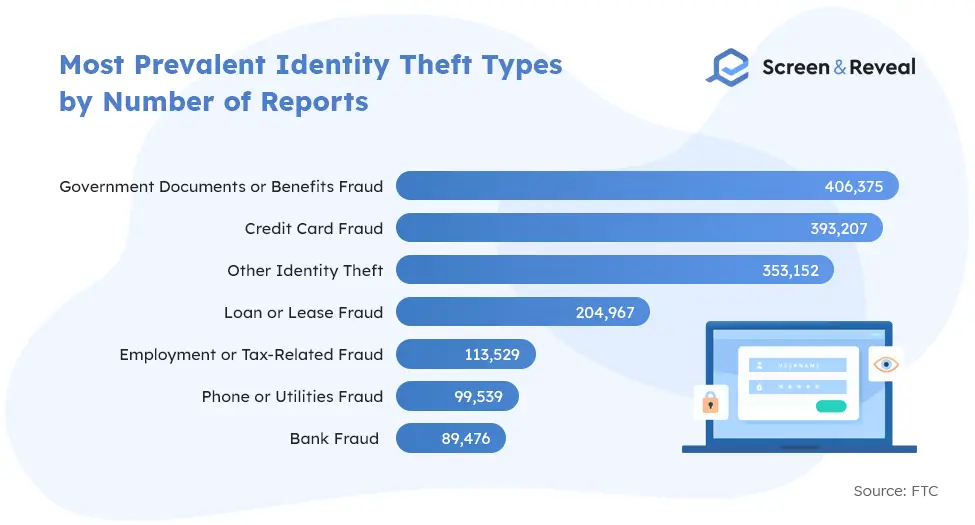

What is the most common form of identity theft?

Financial fraud statistics show the most prevalent form of this type of fraud is financial identity theft by either technological or non-technological. This is usually because identity thieves thrive on financial gain and use your identity to apply for credit cards, get loans, or make purchases in your name.

Who is most susceptible to identity theft?

ID theft stats suggest four primary demographics are the most susceptible. Children, active social media users, high-income earners, and the elderly are at greater risk of having their identities stolen or used to commit fraud. Each of these groups is targeted for different reasons.

What is the most common method used to steal your identity?

Fraudsters use numerous schemes to steal someone’s identity, such as mail theft, social engineering, shoulder surfing, stealing personal items, skimming, phishing scams, credit card theft, and malware. However, identity theft stats suggest that these methods may change depending on your location and demographics.

What are the four types of identity theft?

Currently, there are four main types of identity theft: medical identity theft, financial identity theft, criminal identity theft, and child identity theft. More than two million Americans have had their identity stolen through a health plan or after receiving some form of care.

Do identity thieves get caught?

Frustratingly, it’s very difficult to track down and convict identity thieves, as evidenced by identity theft statistics. Incarceration statistics show that only one in 700 identity thieves is brought to justice. The introduction of new technologies that allow these scams to be perpetrated from just about anywhere makes it much harder to find the people responsible.

Sources: Center for Victim Research, Crime Museum, Javelin Strategy, FTC, Javelin Strategy, Carnegie Mellon University/CyLab, Varonis, OJP, Comparitech, Primo Europe, CreditCards.com, PrivacyAffairs.com, Globe News Wire, Frankonfraud.com, CNBC, Allstate Identity Protection, C.I.M.I.P, LifeLock, Consumer Affairs, Complete ID, OJP