The coronavirus pandemic has put the economy in the shade, yet Americans managed to bring their credit scores under the bright lights.

With the government’s financial help, reduced consumer spending, and monetary relief tactics like balance transfer cards and loan consolidation, many people were able to pay down their debt and increase their credit scores.

Whether you want to get a better handle on your debt, contest any negative elements on your score, and improve it, take a look at the latest credit repair statistics. It doesn’t hurt to stay in the know even if you maintain a healthy credit score.

Credit Repair Statistics (The Highlights)

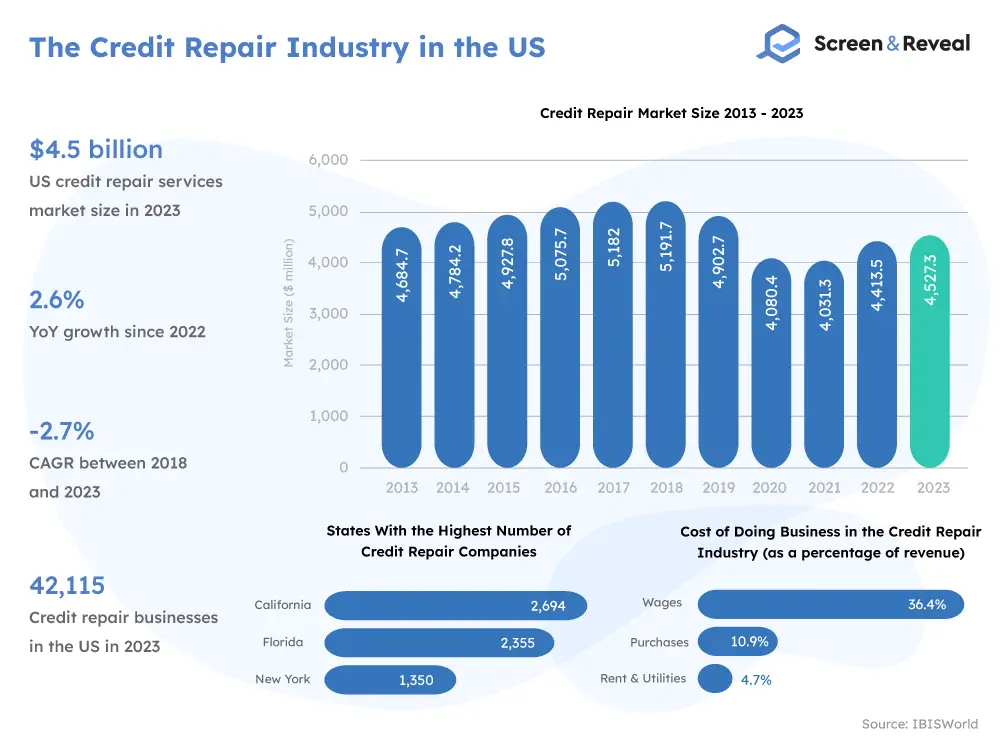

- The US credit repair market size reached $4.5 billion in 2023.

- There are 42,115 credit repair businesses in the US.

- Less than one in five people take copies of their credit reports each year.

- 34% of consumers who have recently checked their credit reports found at least one error on them.

- As of 2022, the average credit score in the US is 716.

- 23.3% of Americans have an exceptional credit score, ranging between 800 and 850.

- 61% of Americans believe income strongly influences their credit score.

- About 48% of consumers who hired a credit repair company got an increase of 100+ points on their credit score.

Credit Repair Industry Statistics

The US credit repair market size reached $4.5 billion in 2023.

The above figure is a result of a 2.6% increase from the previous year. However, the credit repair industry faced a 2.7% drop in the five-year period between 2018 and 2023.

As of 2023, there are 42,115 credit repair businesses in the US.

The above figure marks a 3.8% decrease from the one recorded the previous year. The credit repair industry has been declining by 6.4% annually since 2018.

It has a low market presence in the US, with no companies holding more than 5% market share. The states with the highest number of credit repair companies are California (2,694), Florida (2,355), and New York (1,350).

Wage costs account for 36.4% of revenues in the credit repair services industry.

Credit repair business statistics reveal that purchases account for 10.9%, and rent and utility costs account for 4.7% of the revenue. In general, the entire industry depends more on labor than capital.

Every month, credit reporting agencies receive updates from approximately 10,000 furnishers on 1.3 billion tradelines.

Credit reporting agencies like Equifax, Experian, and TransUnion keep more than 200 million files on consumers. Tradelines include individual credit accounts on a consumer report, such as an account for a mortgage loan, student loans, or credit card debt.

Credit Repair Facts

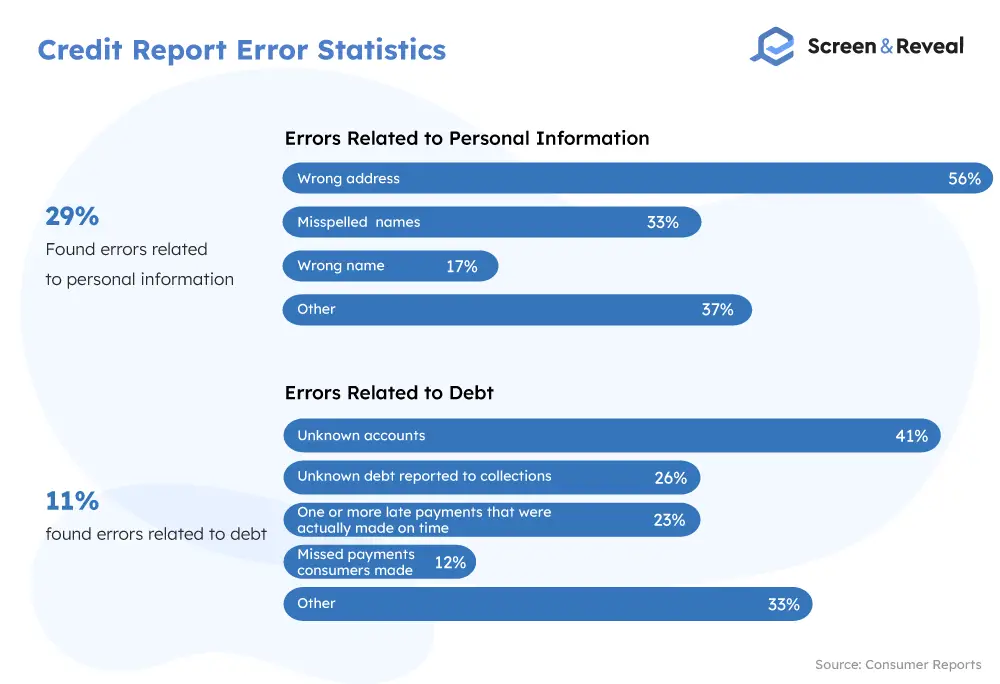

34% of consumers who have recently checked their credit reports found at least one error on them.

Of them, 29% found errors related to personal information. Of those errors, 56% involved incorrect address information, 33% involved misspelled names, and 17% involved having the name wrong altogether. 37% were other kinds of errors related to personal information.

Another 11% found errors related to debt. Of those errors, 41% involved unknown accounts, 26% involved unknown debt reported to collections, 23% involved one or more late payments that were actually made on time, and 12% involved missed payments consumers actually made. 33% were other errors related to debt.

Additionally, 75% of consumers who have accounts that allow them to miss payments saw them as ‘current’ in their credit reports.

While everyone can fix their credit score mistake by themselves, many consumers decide to split the weight with a professional due to the complexity and longevity of the process.

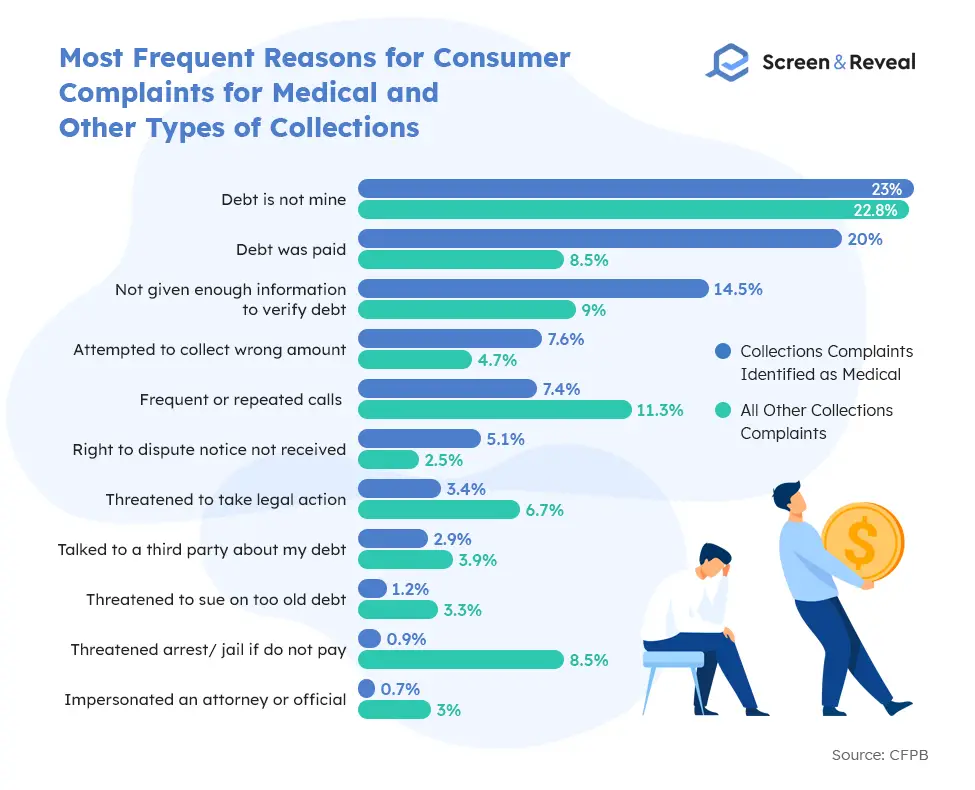

Around 39% of consumer complaints to the CFPB related to collection practices are inaccurate information or claims.

Statistics on credit repair reveal that the most common complaint by consumers is not recognizing the debt as theirs, followed by too frequent or repeated calls, not enough information to verify the debt, debt already paid, and arrest or jail threats.

This indicates that the consumers are mistaken about their accounts, or the debt collectors are going after the wrong consumer or asking for an inaccurate amount of money.

Less than one in five people take copies of their credit reports each year.

The best way to identify errors is to obtain copies of your credit report every year and review the information. Yet, credit repair statistics show that only 44 million consumers in the US ask for a copy of their credit report files.

One-third of consumers (31.6%) have one or more collections tradelines on their credit reports.

Just under a quarter (24.5%) of credit reports contain one or more non-medical tradelines. In comparison, nearly one in five credit reports (19.5%) include one or more medical collections tradelines.

Most collections tradelines are a consequence of unpaid bills rather than outstanding loans, and over half of those collections tradelines (52.1%), are medical.

Over 80% of tradelines by a particular creditor or provider and over two-thirds of all collections tradelines (67.5%) are related to accounts that originated with healthcare, utility, or telecommunications companies.

50% of consumers with only medical collections tradelines have otherwise clean credit reports and show no other evidence of financial instability.

According to credit repair facts, 22% of customers with collection tradelines have only medical debt and are, in general, more reliable payers than consumers with non-medical debt.

Medical collections tradelines are also, in most cases, smaller than non-medical tradelines. The median unpaid medical collections tradeline is $207 with an average of $579, while non-medical collections are $366 with an average of $1,000. The debt on credit cards and student loans is even higher, averaging several thousand dollars.

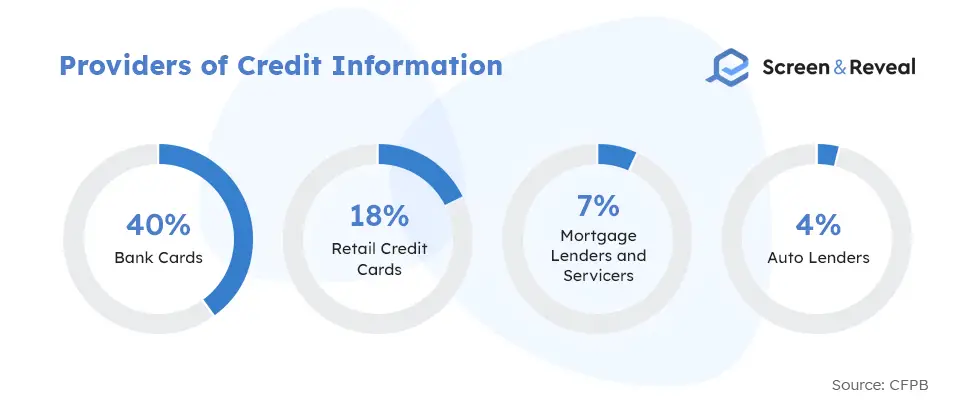

The credit card industry provides over half of the tradelines in credit bureau databases.

Credit reporting companies gather information from many industries, but the majority of account information is provided by credit card companies. According to credit repair industry facts, bank cards, retail credit cards, mortgage lenders of service companies, and auto lenders provide the rest of the information in the credit databases.

As of 2022, the average credit score in the US is 716.

FICO score and VantageScore are the most popular scoring models in the US.

In 2021, the average FICO score reached an all-time high of 716, defined as ‘prime’ by the CFPB and ‘good’ in the FICO range.

The average VantageScore is 701, which falls into the ‘good’ range.

61% of Americans believe income strongly influences their credit score.

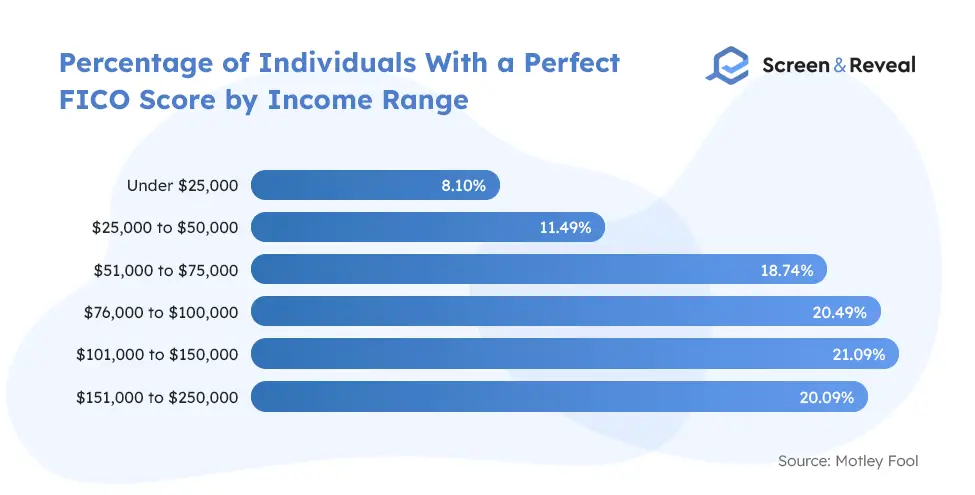

Even though the above is one of the most common credit repair myths, data shows that income has little influence on one’s credit score — Experian reported that 38% of Americans with perfect FICO scores have an income of $75,000 or under. A smaller percentage of individuals with an income of over $150 000 have perfect FICO scores compared to those making between $76,000 and $150,000 annually.

The average percentage of accounts 90 to 180 days past due (DPD) has increased by 0.29%.

Credit repair business statistics show that the percentage of accounts 30 to 59 DPD decreased by 0.63% since 2021, and the percentage of those 60 to 89 DPD also dropped by 0.43%.

Although it seems like a minor increase, the overall percentage of accounts past due in 2022 was relatively small — 1.67% for accounts 30 to 59 DPD, 1.01% for accounts 60 to 89 DPD, and 0.63% for accounts 90 to 180 DPD.

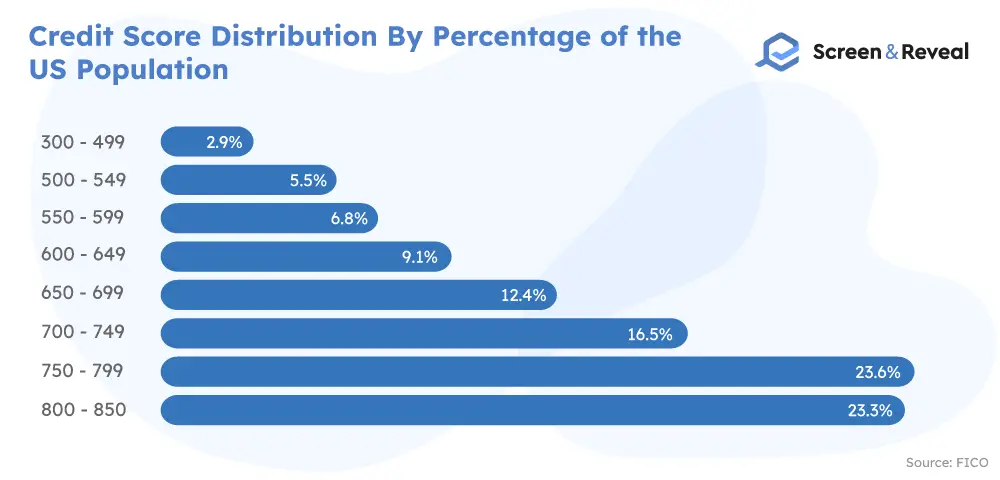

23.3% of Americans have an exceptional credit score, ranging between 800 and 850.

Only 2.9% of the US population struggles with a credit score range between 300 and 499. Looking at the credit score distribution by percentage of the population, the highest percentage of Americans, or 23.6%, is in the ‘very good’ range between 750 and 799.

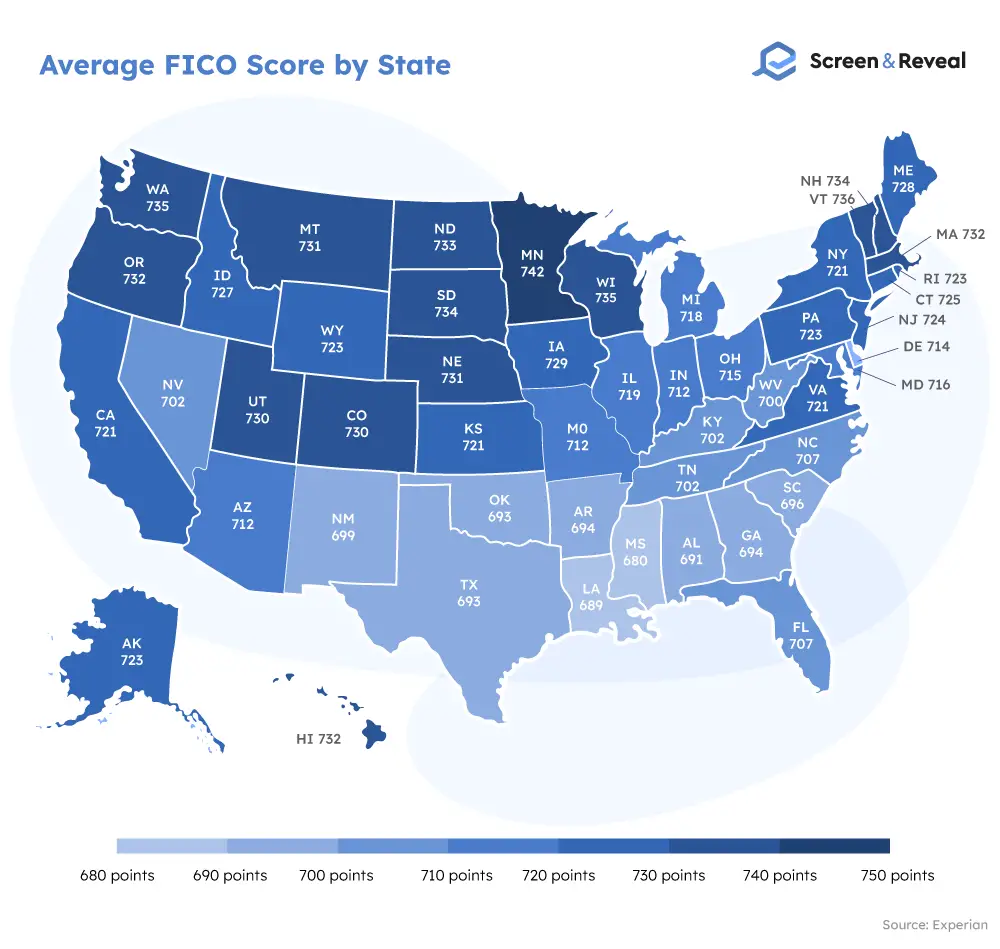

Minnesota is the state with the highest average credit score (742) in the US, while Mississippi has the lowest (680).

According to credit repair facts, consumers in 25 US states experienced no changes in their credit scores between 2021 and 2022.

Credit score statistics reveal that growth was highest in Alaska (six percentage points), and decline was highest in Connecticut (three percentage points).

One in five American adults has no credit history.

These “credit invisible” or unscorable individuals are unable to obtain new lines of credit or have difficulties doing so. They also struggle to find reliable housing, as most landlords ask for permission to obtain credit score reports through third-party tenant screening companies.

In their eyes, having no credit is often viewed as equivalent to bad credit as they don’t have any credit history available to determine if the applicant is capable of covering the rent.

The vast majority of information on credit reports comes from a few large banks and other financial institutions.

More precisely, the top 10 furnishers supply 57% of tradelines, the top 50 furnishers provide 72%, and the top 100 furnishers provide 76% of tradelines.

Consumer-Related Credit Repair Statistics

About 48% of consumers who hired a credit repair company got an increase of 100+ points on their credit score.

According to consumer credit repair data, the above applies to clients who were using credit score repair services for six or more consecutive months.

The corresponding figure for using credit repair companies for one to two months experienced is 33%.

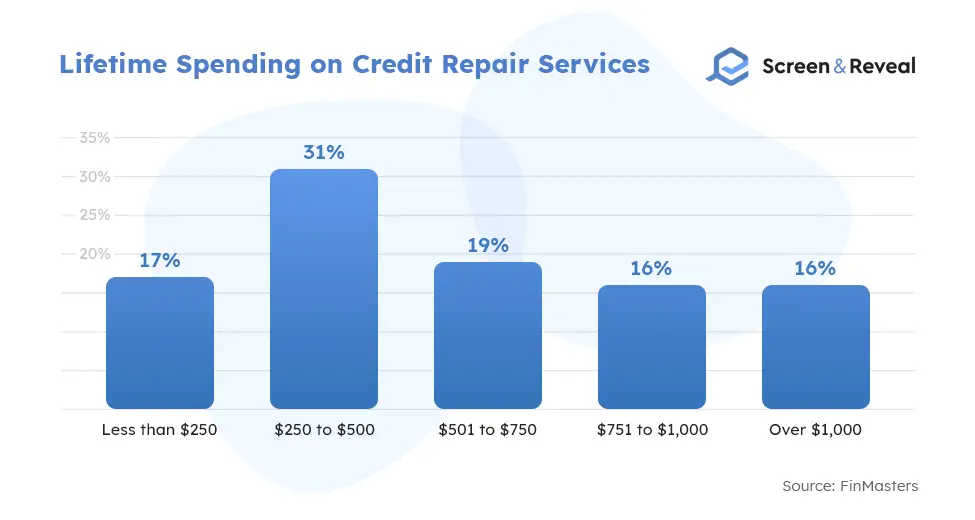

32% of consumers have spent over $750 on credit repair services.

Of those, 48% reported a 100+ point credit score increase.

31% of consumers state their average cost of credit repair, including start-up costs, monthly fees, and additional fees ranges between $250 and $500, while only 16% report spending between $751 and $1,000.

Credit repair industry statistics further reveal that clients who use credit repair services for more prolonged periods tend to spend more on these services.

The most commonly reported credit score gains after hiring a credit repair company range between 100 and 149 points.

26% of consumers who have used credit repair services report a credit score increase in the 100-149 range.

Clients who have used bankruptcy recovery credit repair services increased their credit scores more than clients who have used other types of credit repair services. 53.5% of recipients of bankruptcy recovery services report a boost in their credit score of 100+ points.

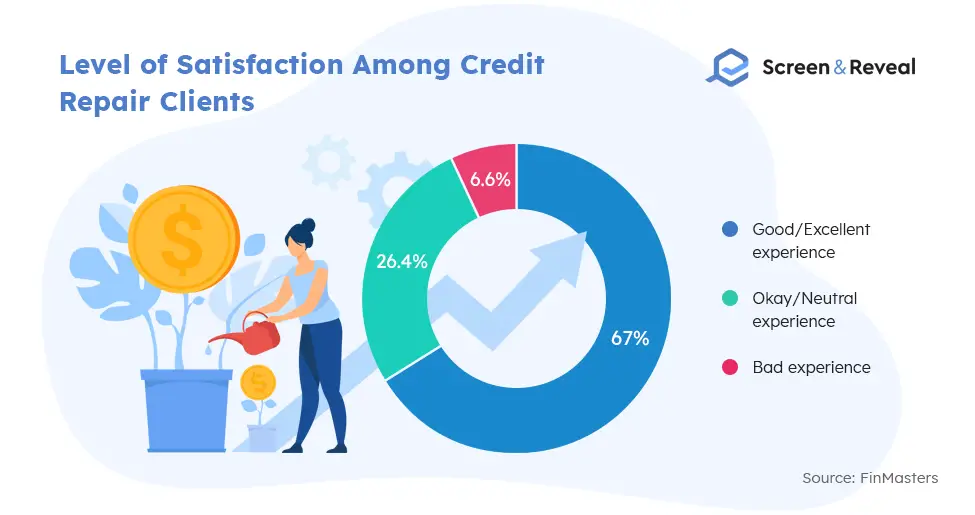

67% of consumers who have used credit repair services rate their experience as good or excellent.

Credit repair industry facts indicate that those who have used credit repair services for more than three months reported an increased satisfaction of 71%.

Another 87% of consumers believed their credit repair company’s practices are professional or fair, while 12% rated their company’s business practices as shady or borderline illegal.

The highest percentage of consumers, or 31%, uses credit repair services between three to five months.

According to consumer credit repair data, 23% rely on credit repair companies for six to nine months, 22% use these services for one to two months, and 18% pay professionals to repair their credit score or fix mistakes for ten months or more.

Most consumers, or 44.6%, reach out to credit repair companies with a credit score between 300 and 579.

Credit repair statistics indicate that 33.4% start using credit repair services with a credit score ranging between 580 and 669.

Consumers who begin with the lowest credit score (300 to 579) typically receive the most significant boost in credit score, with 49.3% reporting an increase of 100+ points.

Credit repair marketing statistics indicate that 45.4% of consumers find credit repair companies via online search.

The internet is the favorite spot for consumers looking for credit repair services, although 37.2% prefer to find a provider through referrals.

Additionally, 13.4% find credit repair services through credit repair advertising, 2.8% through phone solicitation, and only 1% find a company through other channels.

Consumers who find their credit repair company via online search spend more than referral clients.

55.5% of online search clients spend over $500 on credit repair services compared to 48.9% of referral clients who spend the same amount.

Credit repair trends show that these clients experience similar credit score gains, with 27.8% of online search clients and 26.3% of referral clients gaining 100 to 150 points.

Clients coming from advertisements or phone solicitations tend to spend the least on credit repair services, with 46.4% of them spending over $500.

According to consumers who have used credit repair services, billing is the most prevalent issue that arises from hiring one.

25.8% of clients felt the credit repair company had kept them longer than needed, and 18.6% even had trouble canceling the services, compared to 55.2% who felt the billing was as agreed.

Statistics on credit repair show that referral clients tend to experience fewer billing problems than online search clients, with 61.3% and 51.1%, respectively, reporting no billing issues.

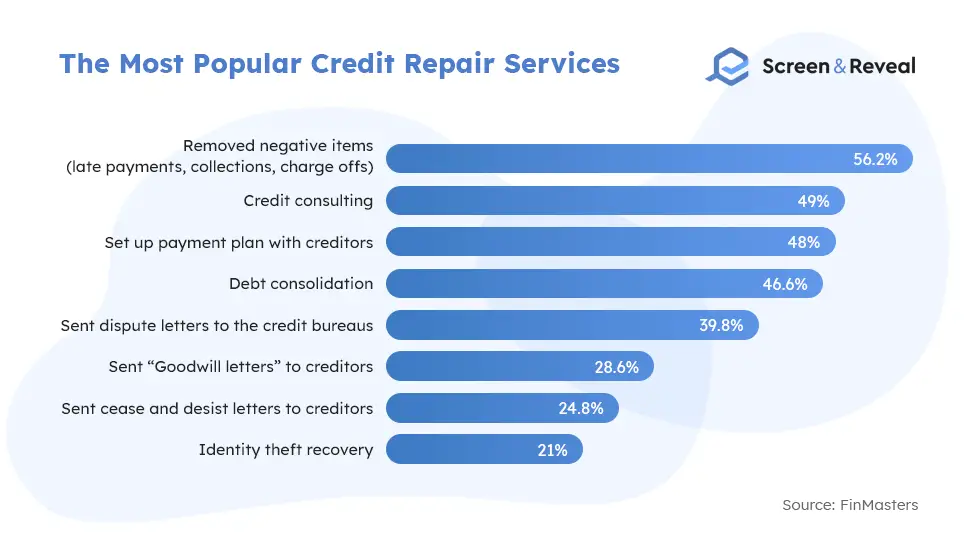

The majority of consumers, or 56.2%, hire a credit repair company to remove negative items from their credit reports.

These negative items include collections, late payments, and charge-offs. 49% of consumers have also received consulting services from their credit repair company, while 48% have used credit repair services to set up a payment plan with creditors.

55.2% of consumers had collections successfully removed from their credit score with the help of a credit repair company.

Credit repair facts show that other items that clients had successfully removed after working with a credit repair company include late payments, medical bills, charge-offs, inquiries, judgments, student loans, and bankruptcies.

The Summary

Even though credit scores have increased during the pandemic, the global cost-of-living crisis still puts people in debt, making the credit repair industry more indispensable than ever when it comes to consumers’ maintenance of their financial well-being.

Sources: CFPB, CFPB, Consumer Reports, Experian, FICO, FICO, FinMasters, IBISWorld, IBISWorld, Motley Fool, Motley Fool, VantageScore